Our Channel Management feature is extremely powerful and can greatly simplify your channel advertising. Learn how it works by reading our Channel Management overview article. The most powerful part of our Channel Management is the API Integrations we have with certain channel partners like Airbnb.

This article explains how taxes work specifically for Airbnb. Airbnb can be more complex for tax settings than other channels, because the possible scenarios are more complex than with other channels.

There are two concepts that are important when thinking about taxes: who collects the taxes from the guest, and who remits the taxes to the taxing authorities. Most channels will let you configure all of the taxes applicable in your area. Then, the channel will collect all of the taxes, include them in your payout, and you will remit all of the taxes.

That scenario can happen with Airbnb. But there are also more complex scenarios where Airbnb collects and remits some of the taxes and you collect and remit other taxes, or maybe they don't support collection in your area at all and you have to roll the taxes into your rates and remit them all yourself.

Taxes collected by Airbnb can only be paid out to the default Airbnb account payment method, regardless if the property has a different payment method configured in Airbnb.

First, read through the possible scenarios and figure out which one applies to you. Then follow the directions in the Configuration section to configure them.

We recommend remitting the taxes yourself if you can, because that makes Airbnb act like other channels and simplifies how you have to report the taxes.

Possible Scenarios

The first question is, does Airbnb by default collect all of the taxes in your area? In some areas, Airbnb will collect and remit all taxes, which makes things fairly straightforward. We still recommend remitting the taxes yourself if you can, but as long as Airbnb is already collecting them all, you could just let them remit them as well.

OwnerRez users that have Airbnb listings located in Mexico should note that Airbnb will always collect and remit Value Added Tax (VAT) in Mexico regardless of any passthrough tax settings set in OwnerRez.

Users should never attempt to set a passthrough tax for Mexico VAT since Airbnb will override and remit it anyway. Any Mexico VAT tax a user sets whether in Airbnb or OwnerRez will result in duplicate taxes.

If Airbnb collects some but not all taxes in your area, then you have to figure out how to collect the remaining taxes. If they support custom taxes in your area, we highly recommend using that method to collect the additional taxes that they don't. If not, OwnerRez can be configured to include the taxes in the rates pushed to Airbnb and then back them out to display them correctly in OwnerRez, but that's a lot more complex. We don't recommend or support that method if you can use custom taxes.

You can read more about what Airbnb collects by default in Airbnb's Tax Collection and Remittance article.

There are four possible modes for custom/passthrough taxes on Airbnb. You can see the mode for a property on the Airbnb Taxes dashboard in OwnerRez as described in the Testing and Verification section below.

NOTE: Airbnb chooses the mode for every listing based on the property location, and neither you nor OwnerRez have control over the tax mode. If you believe Airbnb has selected the mode for your listing in error, contact Airbnb support.

Here's what these modes mean:

Ineligible

When a listing is ineligible for custom taxes, that means that you can't set custom taxes for the listing. Airbnb may or may not collect and remit certain taxes for this listing.

First, check to see if they do collect and remit all of the taxes you need for the listing. If they do, then you're good to go -- just let them collect and remit all of the taxes.

If they don't collect and remit all of the taxes in your area, you'll need to configure OwnerRez to include the taxes in the nightly rate. To do this, first go to the Airbnb channel settings in OwnerRez and enable inclusive taxes:

Then, go to Settings > Taxes and make sure you've got the correct taxes configured and applicable to Airbnb. In this mode, OwnerRez will add the taxes to the rates it pushes. Then, when importing a booking, it will remove the taxes back out of the rate and create separate charge line items for them in OwnerRez.

Then, go to Settings > Taxes and make sure you've got the correct taxes configured and applicable to Airbnb. In this mode, OwnerRez will add the taxes to the rates it pushes. Then, when importing a booking, it will remove the taxes back out of the rate and create separate charge line items for them in OwnerRez.

None

Airbnb doesn't collect taxes, hosts can add custom taxes. If there are no taxes in your area, there's nothing to do here.

If there are taxes in your area, configure them following the instructions below and Airbnb will collect them and pass them through to you for remittance.

Override

Airbnb automatically collects certain taxes and remits them. Hosts who would like to assume the responsibility of remitting all taxes anyway, can opt-out of Airbnb's automatic tax collection and remittance by adding your own custom taxes instead.

NOTE: in Override mode, tax remittance is all or nothing. If you set any passthrough taxes for Airbnb, they will collect only the taxes you set in OwnerRez -- they won't keep remitting taxes they were remitting before you set passthrough taxes in OwnerRez. Those taxes collected will be sent to you with your Airbnb booking payout, and you, the host, will be responsible for remitting and submitting those taxes to your local tax authorities.

Stacked

Airbnb will collect and remit certain taxes directly to tax authorities, and will also collect any additional taxes set by the host and remit them directly to the host.

NOTE: Airbnb does not check taxes for duplication. If they're collecting a tax and you accidentally configure the same tax as a passthrough tax in OwnerRez, Airbnb will collect and remit the tax and then also collect and pass through the tax to you based on that setting.

Configuration

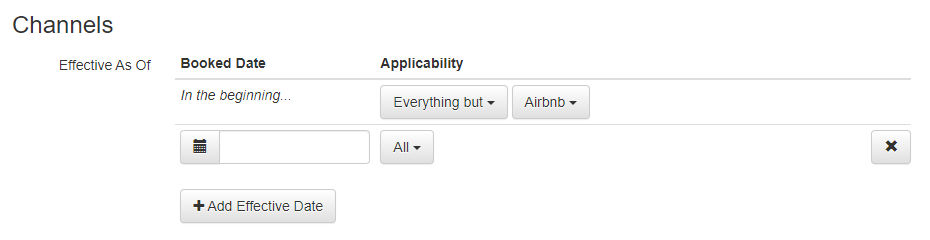

Now that you've seen the scenarios, you can choose how to configure them. General applicability is controlled by the Channels setting on the tax. If you set applicability to "everything but Airbnb" or don't have passthrough tax fields set, then that tax will not apply to Airbnb. Airbnb will continue to collect and remit taxes for your listings if that's what you had set in Airbnb before going API. This is the default behavior and it will continue to work after you go API.

However, Airbnb allows you to turn this off and do "pass-through" taxes. This means that Airbnb will collect the tax from the guest, but then pass that money through to you to remit to the tax authority. This makes it your responsibility to actually remit the collected tax to each appropriate taxing authority.

Airbnb only allows this in some areas, though, so first check to see if it's allowed. You can see this in the Airbnb Mode column on the Airbnb Taxes dashboard in OwnerRez as described in the Testing and Verification section below.

If pass-through taxes are allowed, then come back to OwnerRez and configure them using the instructions below.

⚡ WARNING:

DO NOT enable the custom taxes option directly in Airbnb! If you do it in Airbnb, the setting will be overwritten next time OwnerRez syncs.

To create a tax in OwnerRez that will go to Airbnb as a custom tax:

- Go to Settings > Taxes

- If you've already got the tax created, edit it. Otherwise create the new tax.

- If it is a pre-existing tax, make sure the Channels setting matches Airbnb as of today.

- Populate the Type, Business Tax Id, Registration Number, and Attestation fields. All of these are required for a tax to pass-through to Airbnb.

The Registration Number is a number assigned by the authority to which you remit the tax. It could be anything - your existing SSN or other tax ID, a unique number assigned by that taxing authority, even your name. Normally the taxing authority asks you to put this number on your check when you send in a payment. Occasionally, a taxing authority is so small that they know who you are and don't bother assigning a number - in that case, just put your name / company name. But you cannot just leave it blank, or Airbnb won't collect the tax for you.

- That's it -- the tax will now be pushed to Airbnb as a custom pass-through tax.

- Repeat with any additional taxes you have to collect - each individual separate tax authority needs its own entry.

👉 Stuff to watch out for:

- If you switch to custom taxes, you must configure all of your taxes with the appropriate criteria. Make sure to check the options on the tax page in Airbnb and on the tax dashboard in OwnerRez. If the mode is

Passthrough, Airbnb won't remit any tax for you (even if they used to remit some of the taxes in your area). Airbnb will collect all of the taxes you configure and include them in your payout, and then it's up to you to remit to all of the appropriate taxing authorities. If the mode isStacked, Airbnb will continue remitting the tax they originally did and you can add additional taxes. - If this was a pre-existing tax, make sure that the Listing Sites criteria is set to All or doesn't exclude Airbnb. You may have excluded Airbnb in the past if Airbnb was remitting some or all of your taxes.

- We strongly recommend breaking out each separate taxing authority into an individual Tax in OwnerRez/Airbnb rather than combining your total percent of taxation into one tax. This will allow you to break things down by tax and run reports for different taxing bodies. Do not attempt to combine them all into one single giant "Tax" entry - it may seem easier, but if you ever get audited by the tax authorities, you'll wish you hadn't.

- Airbnb only supports flat per guest, flat per night, flat per guest and night, and percent per reservation taxes. They do not support flat per stay taxes.

- Airbnb does not support future dated rate changes -- they only support one effective rate, so the rate effective as of now will be pushed.

Tax Rate Changes

Changes to Airbnb tax rates will only be applied to new bookings as they come in. They do not retroactively apply to any bookings that already exist, even if their dates of applicability would otherwise mean that they should.

- Airbnb does not support future tax rate changes. This means that bookings placed prior to the date of the tax change will continue to be charged the current (old) tax rate until the date of the tax rate change--even if the arrival occurs in the future changed tax rate.

- The only way to collect additional taxes is by using Airbnb's Resolution Center.

Testing and Verification

Once you've configured the taxes, it's important to test them to make sure that you configured them how you intended.

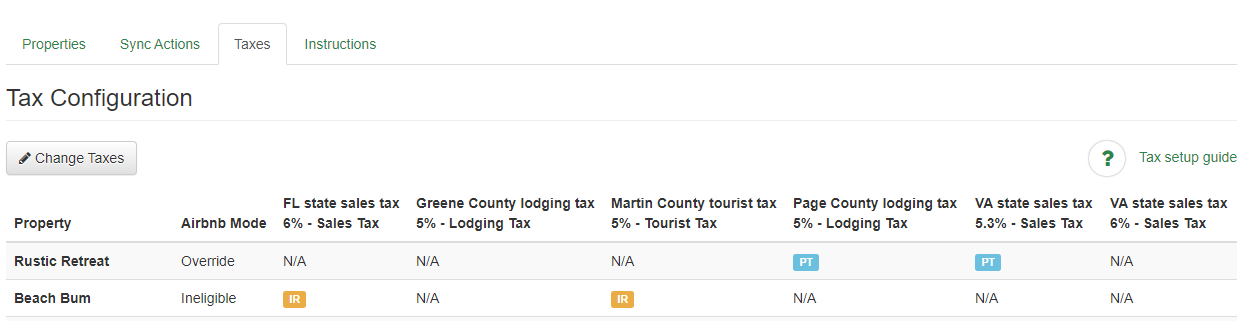

First check is to go to the Taxes tab on the Airbnb channel in OwnerRez. This dashboard will show all of your connected properties and taxes and which mode they are in.

The Airbnb Mode column shows whether you can set custom taxes on Airbnb or the listing is ineligible for custom taxes. Then, each tax has its own column that shows if the tax is configured to be passed through to you, included in rate, or isn't applicable to that listing.

If everything looks good on the tax configuration, then to your Airbnb listing as a guest and get a quote. Make sure that looks good as well -- all the taxes that should be included are included and there are no extra or duplicate taxes.

Airbnb does not display the taxes early in the process! You have to actually get all the way through to after clicking the Reserve button - basically, the last screen where you're supposed to pay. That's where the taxes finally show up.

Finally, keep a close eye as the first couple of bookings come in and double check the taxes are recorded in OwnerRez as you'd expect.

Reporting

For taxes that are completely handled by Airbnb, meaning that you, the host, never see or touch taxes collected by Airbnb and Airbnb remits your collected taxes directly to your local tax authorities, no tax information will appear in either individual bookings or OwnerRez Tax Reports.

However, some jurisdictions will still expect property owners to file a report of the taxes that Airbnb submitted on their behalf. OwnerRez does not have a very good way of reporting this, but tax information does appear on the Listing Site Fees Report.